Effortlessly Streamline Your Restaurant Credit Card Processing Today!

At 1st Choice Card Payments, we are acutely aware of the economic challenges that restaurants face, including high levels of inflation, reduced consumer spending, labour shortages, and rising staff costs, which is why we’ve tirelessly searched for the best deals to help you.

You know that card processing is essential to your business operations as a restaurant owner. Therefore, we provide cost-effective, reliable, secure mobile (GPRS) and Wi-Fi card machines for the hospitality sector.

Our EPOS systems can help you manage your business daily and increase sales opportunities. If you’re looking to take payments, take bookings and accounting, or combine all three, then an EPOS system could be the right choice.

How much are restaurant credit card processing?

The cost of payment processing can vary based on the card used by your customer, typically ranging from 0.4% to 2% per transaction.

In addition, you may also encounter transaction fees, authorisation fees, and merchant service fees.

We publish all our prices upfront, transparent rates, easy payment solutions, no hidden fees and complicated bills.

Mobile Card Machines

WiFi and GPRS Machine

Ingenico AXIUM DX8000 series

Early Bird Offer

Limited Time Offer: 31/05/2023- 0.49% Debit Cards

- 0.89% Credit Cards

- 2p Authorisation Fee

- £5.00pm PCI Compliance

- 18 Month Agreement

- Next Day Funding Available

- UK Based Support

Portable Card Machine

WiFi or GPRS Machine

Clover Flex POS system

FREE for 3 months

Limited Time Offer: 31/05/2023- 0.40% Debit Cards

- 0.65% Credit Cards

- 2p Authorisation Fee

- £5.00pm PCI Compliance

- 36 Month Agreement

- UK Based Support

EPOS Systems

All in One System

Clover Station Pro.

CLOVER Station

No Upfront Charges- 0.4% Debit Cards

- 0.65% Credit Cards

- 2p Authorisation Fee

- 48 Month Agreement

- Next Day Funding Available

- £5.00pm PCI Compliance

- Includes: Clover Station Duo

- Includes: Clover Mini

- Includes: Clover Cash Drawer

- Includes: Clover Printer

- Includes: Software

Don’t pay 1.5% on card transactions.

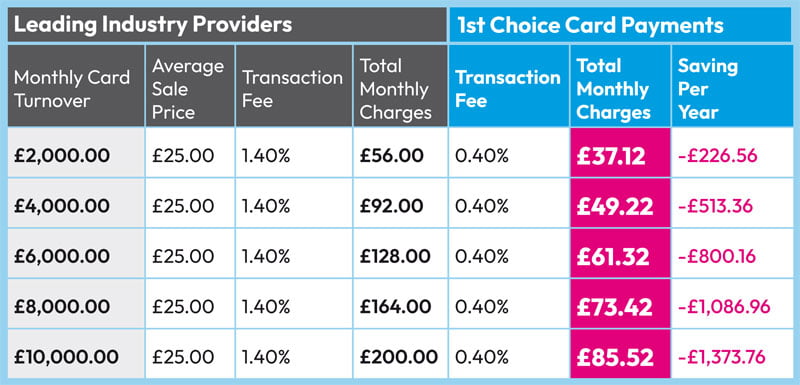

Our clients receive a 50% lower rate on their card processing fees compared to the leading providers.

We work hard to find the best card machine deals, so you don’t have to.

Our pricing is completely transparent, with upfront rates, simple payment options, and no hidden charges or confusing bills. We also offer free consultations and customer service, so you can count on us as your partner rather than just a service provider

Leading Industry Providers: £20.00 Monthly Terminal Rental. 1.40% Transaction Fees. £0.05 Authorisation Fees. £0.05 Secure Transaction Fee.

1st Choice Card Payments: £20.00 Monthly Terminal Rental. 0.40% Debit Card Transaction Fees. 0.65% Credit Card Transaction Fees £0.02 Authorisation Fees. £0.00 Secure Transaction Fee. £5.00pm PCI Compliance Fee.

What to look for in a payment solution

Choosing the right payment processing solution for your restaurant can be daunting. Therefore, we base all our credit card processing solutions on what is fast, reliable, secure, and convenient for your customers.

- Cost-effectiveness: We offer payment solutions that are very competitive with transparent fees.

- Speed and Reliability: All our Card Machines and EPOS system are the best in class. Fast, efficient and reliable so that customers can quickly pay their bills and move on.

- Security: Payment security is critical to protect your restaurant and the customer’s sensitive information. All our payment solutions meet the latest security standards, such as PCI-DSS compliance, to ensure that their customers’ data is safe.

- Integration: Our payment solutions integrate with the restaurant’s point-of-sale (POS) system and accounting software so that transactions can be tracked and reconciled easily.

- Support: Our customer support can be critical for resolving any issues with the payment solution and ensuring that transactions run smoothly.

See these on your bill?

Are you tired of your current Restaurant Credit Card Processing provider’s poor customer support and high processing fees? It might be time to switch to a new provider offering better services and more favourable terms.

A minefield of hidden charges can cost businesses money. We help you find the best merchant provider for your business. Many customers ask how we can explain fees in more detail, reduce charges or remove unnecessary fees, for example;

- PCI Compliance, Non-Compliance and Management Fees

- Authorisation Fees

- Minimum Monthly

- Pence per Transactions

- Setup & Exit Fees

- Paper Statement Fees and Reporting Fees

- Chargeback Fee

We may even be able to help you get out of your current contract. We’ll also negotiate with the card payment company on your behalf, so that you can get the best possible deal.

Why Choose 1st Choice Card Payments.

There are a few things that set us apart from our competition besides honesty and transparency.

- We publish our rates and prices upfront.

- We are completely independent; this allows us to source the latest and best deal for you.

- There's no need to talk to a pushy sales rep.

- We specialise in small businesses.

- We can support and advise on PCI, Merchant service charges, Compliance fees, EPOS systems, Card terminals, Payment Gateways, Virtual Terminals, and much more.

- All our service centres are in the UK, with dedicated staff ready to provide excellent customer service.

- We are located in Nottingham but serve the East Midlands.

At 1st Choice Card Payments, we understand the importance of accepting card payments, and we’re here to help you find the best card machine for your needs at a price that fits your budget.

With a wide range of options to choose from, you can compare prices and features to find the best machine for your business. We publish all our prices upfront, with no hidden fees and complicated bills, so you know what it costs monthly, leaving you to focus on growing your business.